How to Buy a House That Needs Renovation

At Cameron Construction, we’ve seen countless homeowners transform fixer-uppers into dream homes.

Buying a house in need of renovation can be an exciting yet challenging endeavour. It requires careful planning, a keen eye for potential, and a solid understanding of the renovation process.

In this guide, we’ll walk you through the essential steps to successfully purchase and renovate a property that needs some TLC.

What Makes a Property Worth Renovating?

Look Beyond the Surface

When you buy a house that needs renovation, you must assess its potential. At Cameron Construction, we’ve witnessed numerous properties transform from rough diamonds to stunning homes. The key is to distinguish between structural issues and cosmetic repairs.

Cosmetic fixes (like outdated wallpaper or worn carpets) are relatively easy to address. Structural problems, however, can be costly and complex.

Check for these signs:

- Foundation issues (cracks in walls or uneven floors)

- Roof damage or wear

- Water stains (which might indicate plumbing problems)

These issues can significantly impact your renovation budget.

Crunch the Numbers

You must estimate renovation costs accurately. Get multiple quotes from contractors for major work. Factor in materials, labour, and permits. Don’t forget to budget for unexpected issues – add 20% to your initial estimate as a buffer.

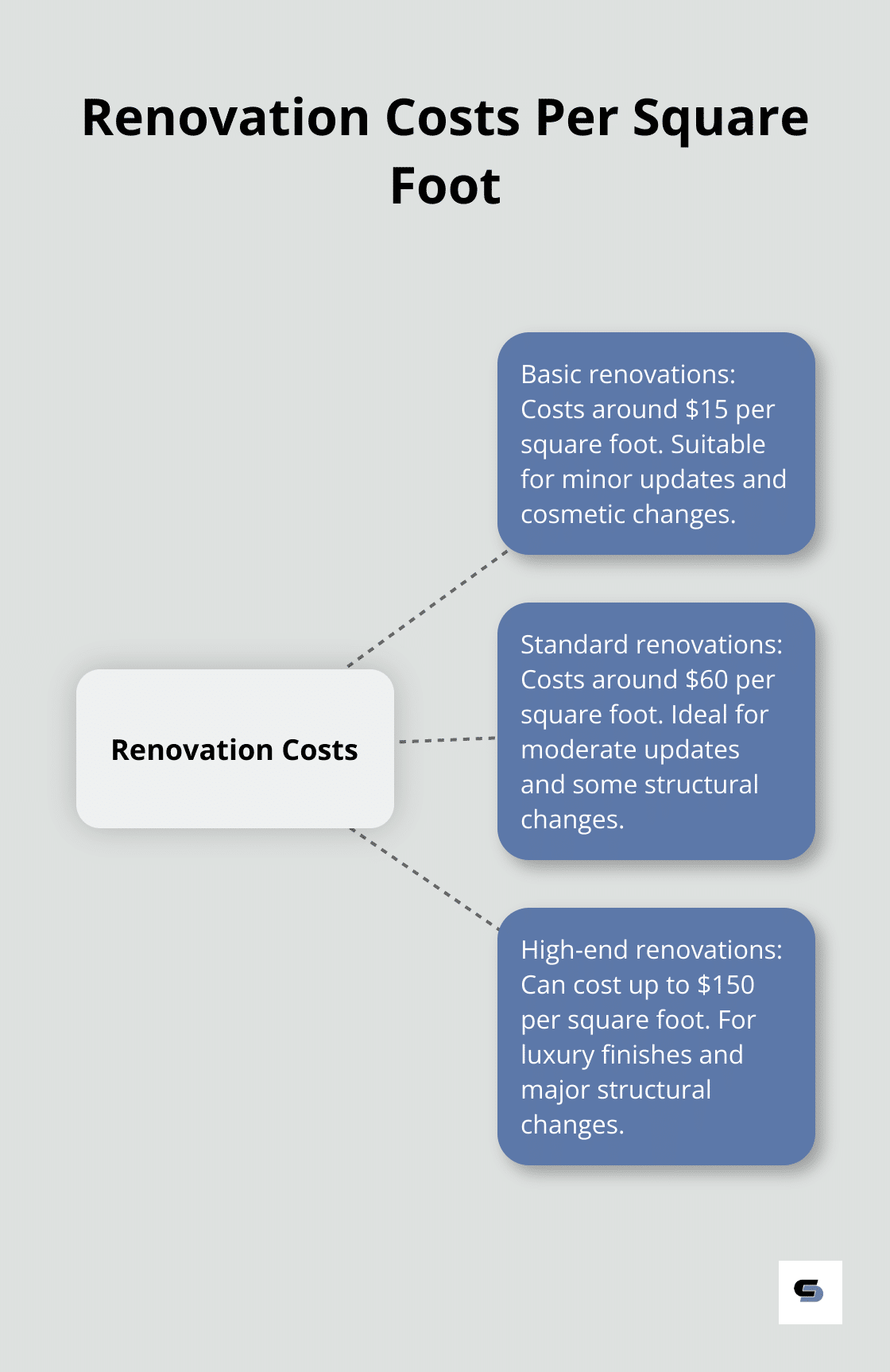

Renovating a house often costs between $15 and $60 per square foot-though high-end renovations might cost $150 per square foot.

Location Matters

The neighbourhood plays a crucial role in determining future property value. Research local property trends and upcoming developments. Ask yourself:

- Are house prices in the area rising?

- Are there plans for new amenities or infrastructure?

Consider the maximum value of homes in the neighbourhood. You don’t want to over-improve for the area, as this can limit your return on investment. The Australian Bureau of Statistics reports that properties in well-located areas tend to appreciate faster (often by 7-10% annually in major cities).

Calculate Potential Return on Investment

Estimate the property’s value after renovation and compare it to your total costs (purchase price plus renovation expenses). This “after repair value” (ARV) should be significantly higher than your total investment to make the project worthwhile.

Try to focus on renovations that add the most value. Kitchen and bathroom upgrades typically offer the best returns, often recouping 80-90% of their cost at resale according to Remodelling Magazine’s Cost vs. Value Report.

Buying a fixer-upper isn’t just about immediate profit. It’s about creating a home that meets your needs while building equity over time. With careful assessment and planning, a house in need of renovation can become both a rewarding project and a smart investment.

Now that you understand how to assess a property’s potential, let’s explore how to finance your fixer-upper project.

How to Finance Your Fixer-Upper

Renovation Loans: Your Financial Ally

Securing the right financing for your fixer-upper is essential. Renovation loans let you draw down funds as needed during renovations, helping manage cash flow and reduce interest costs over time.

The most common types include:

- Construction loans: These allow you to draw funds progressively as renovations progress. You pay interest only on the amount used, which can save you money during the renovation process.

- Home equity loans: If you already own a property, you can borrow against its equity. These typically offer lower interest rates than personal loans.

- Line of credit: This flexible option lets you borrow up to a certain amount as needed, paying interest only on what you use.

Government-Backed Programs: Hidden Opportunities

Several government-backed programmes can help finance your fixer-upper:

- Stamp duty concessions and First Home Owner Grant schemes may be available to first home buyers purchasing an existing property.

- Regional Construction Loan: This program may offer support for those looking to renovate in regional areas.

- Energy-efficient home loan: Some lenders offer discounted rates for renovations that improve energy efficiency. This can save you money on both your loan and future energy bills.

Budget for the Unexpected

Renovations often come with surprises. We advise our clients to add a buffer to their budget. Here’s how:

- Add 20% to your initial budget for unexpected costs. This could cover issues like hidden structural problems or sudden material price increases.

- Obtain detailed quotes from multiple contractors. This gives you a realistic idea of costs and helps you spot potential overcharging.

- Prioritize your renovations. Focus on essential repairs first, then move to cosmetic upgrades. This ensures you don’t run out of money for critical work.

- Consider a staged renovation approach. This allows you to spread costs over time and adjust your plans based on what you discover during the process.

Financing a fixer-upper isn’t just about getting the money. It’s about smart planning and strategic use of available resources. With the right approach, you can turn that diamond in the rough into your dream home without breaking the bank.

Now that you understand how to finance your fixer-upper, let’s explore how to create an effective renovation strategy that maximizes your investment and minimizes stress.

How to Create a Winning Renovation Strategy

Set a Realistic Timeline

A successful renovation starts with a solid strategy. This approach maximizes your investment and minimizes stress throughout the process.

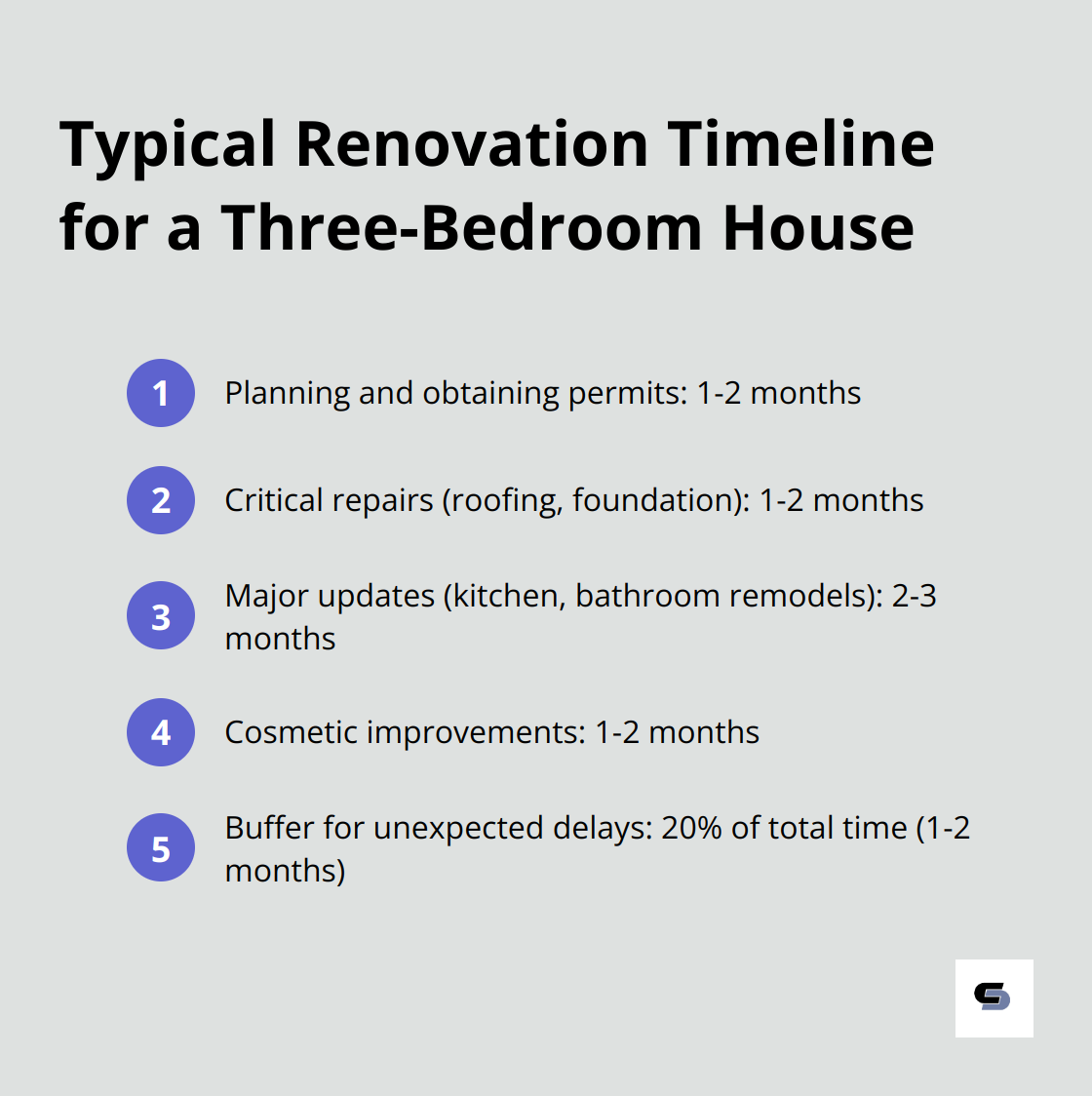

For a typical three-bedroom house, allow 4-8 months for major renovations. This timeline includes planning, obtaining permits, and the actual construction work.

Break your project into phases:

- Start with critical repairs (roofing or foundation work)

- Move on to major updates (kitchen or bathroom remodels)

- Tackle cosmetic improvements

Unexpected issues can arise. Add 20% to your estimated timeline to account for delays.

Prioritize for Maximum Impact

Focus on renovations that offer the best return on investment. Kitchen and bathroom upgrades typically yield high returns, often recouping a significant portion of their cost at resale.

Energy-efficient upgrades are worth prioritizing. The Household Energy Upgrades Fund will help more than 110,000 households lower their energy bills, ensuring homes are warmer in winter and cooler in summer. This reduces your living costs and appeals to future buyers.

Don’t neglect kerb appeal. A well-maintained exterior can increase the perceived value of your home.

DIY vs Professional Help

While DIY can save money, it’s not always the best choice. Complex jobs like electrical work, plumbing, or structural changes require professional expertise. Mistakes in these areas can be costly and dangerous.

For simpler tasks (painting or landscaping), DIY can be a cost-effective option. However, assess your skills honestly. Poor workmanship can decrease your home’s value.

When hiring professionals, get at least three quotes. Check references and ensure they’re licensed and insured. Quality workmanship can significantly impact the final result and your home’s value.

Manage Your Budget Effectively

Create a detailed budget for your renovation project. Include costs for materials, labour, permits, and a contingency fund (about 10-20% of your total budget).

Try to get fixed-price quotes from contractors to avoid cost overruns. This helps you stick to your budget and prevents unexpected expenses.

Consider the long-term value of your choices. Sometimes, spending a bit more on high-quality materials or energy-efficient appliances can lead to savings over time.

Stay Flexible and Adaptable

Renovations rarely go exactly as planned. Be prepared to make adjustments as you go. This might mean changing your design slightly or reallocating your budget based on unexpected discoveries.

Keep open communication with your contractors. Regular check-ins can help you stay on top of progress and address any issues promptly.

Final Thoughts

Buying a house in need of renovation presents both challenges and opportunities. You must assess the property’s potential, secure appropriate financing, and create a solid renovation strategy. This approach will help you transform a fixer-upper into your dream home while potentially increasing its value.

The journey of renovating a fixer-upper requires patience and proper planning. You can turn a rough diamond into a true gem by focusing on the property’s structure and location, estimating costs accurately, and prioritizing renovations. A realistic timeline and budget will minimise stress throughout the process.

We at Cameron Construction have helped many homeowners successfully navigate the path of buying and renovating houses that need work. Our team of experts stands ready to bring your vision to life and ensure your renovation project exceeds expectations. Contact us today to start your renovation journey and create a home that’s both beautiful and valuable.