Home Improvement Financing Options and Solutions

Home improvement projects can transform your living space, but funding them often presents a challenge. Most homeowners need external financing to complete major renovations.

We at Cameron Construction understand that choosing the right home improvement financing option makes the difference between a successful project and financial stress. The key lies in matching your specific situation with the most suitable funding solution.

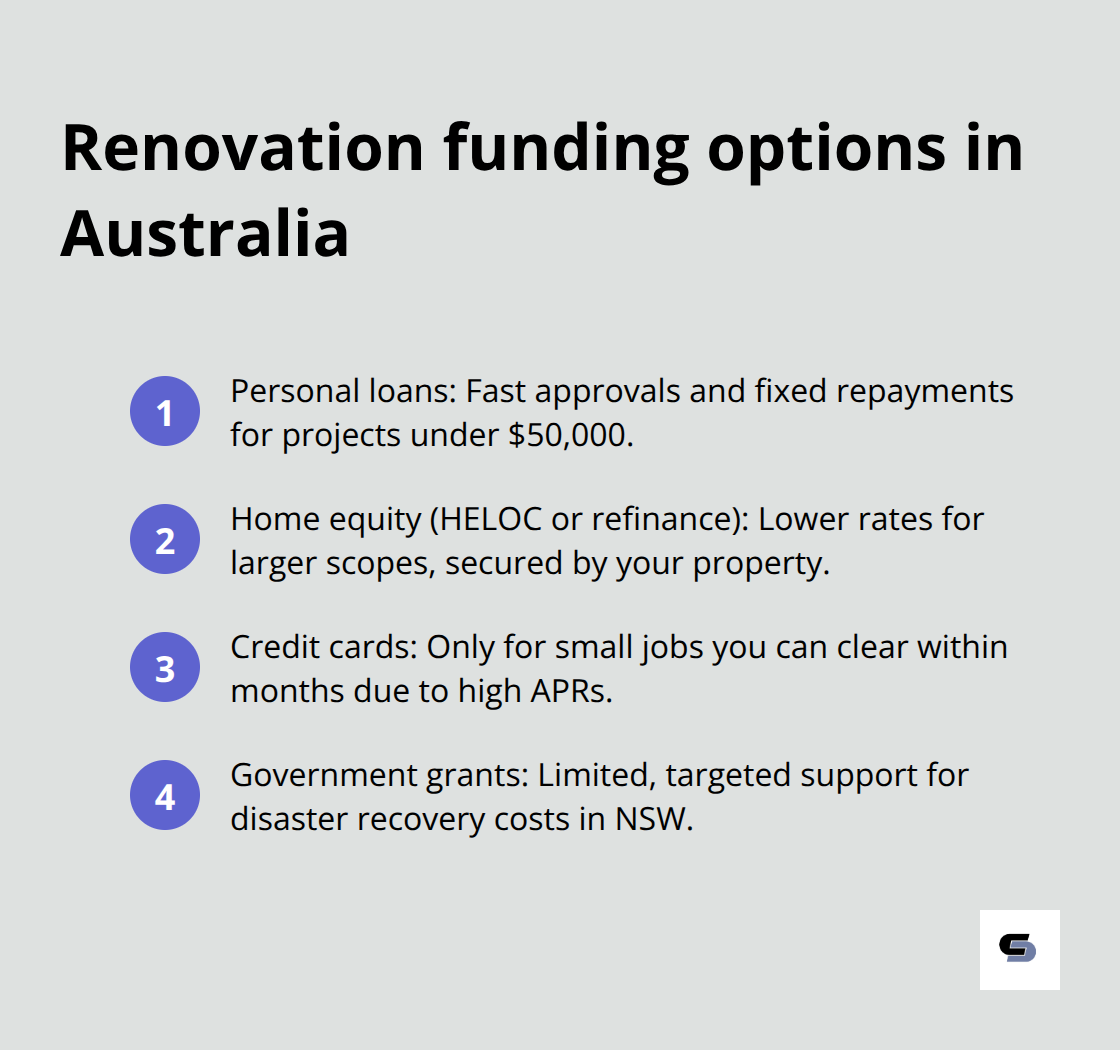

Which Financing Options Work Best for Your Renovation

Personal loans lead the home improvement market for solid reasons. Money.com.au reports the average personal loan amount reaches $22,643, with interest rates that span from 5% to over 10%. These unsecured loans provide amounts up to $50,000 without your home as collateral, which makes them ideal for kitchen renovations that cost $10,000 to $45,000 or bathroom updates that range from $10,000 to $35,000. Personal loans deliver same-day approval in many cases and keep your renovation expenses separate from the mortgage.

Home Equity Solutions Deliver Lower Rates

Home Equity Lines of Credit provide competitive rates and allow you to borrow up to 85% of your home equity. This option works best for large-scale projects that require staged payments over extended periods. The drawback comes with variable rates that create unpredictable monthly payments, plus fees that range from 2% to 5% of the loan amount. Cash-out refinance provides another route and replaces your existing mortgage with a larger one to access improvement funds.

Credit Cards Suit Quick Small Projects

Credit cards make sense only for minor renovations you can pay off within months. The Federal Reserve data from February 2025 shows credit card APRs average 21.91% compared to 11.66% for personal loans. About 42% of homeowners use credit cards for renovations (according to Statista), but this creates expensive debt if balances carry over. Speciality retail programs often provide 0% promotional periods, though rates spike dramatically after the promotional window ends.

Government Grants Support Disaster Recovery

The NSW Home Repair Grant provides up to $25,000 for homeowners affected by severe weather events, with household income limits below $100,000 per year. This program targets uninsured properties that need repairs to meet basic safety standards. Applications run from August 25, 2025, to December 1, 2025, and cover utilities, structural repairs, and debris removal costs.

Each option serves different project scales and financial situations, which leads us to examine the specific factors that determine your best choice.

What Makes or Breaks Your Financing Decision

Your credit score determines which doors open and which slam shut in home improvement financing. Borrowers with excellent credit seeking high loan amounts and flexible terms can qualify for some of the lowest APRs available. The difference costs thousands – a $30,000 personal loan at 6% versus 12% means you pay $3,600 more in interest over five years. Check your FICO score before you shop and spend 3-6 months to improve it if needed. Pay down existing balances, avoid new credit applications, and dispute any errors on your credit report.

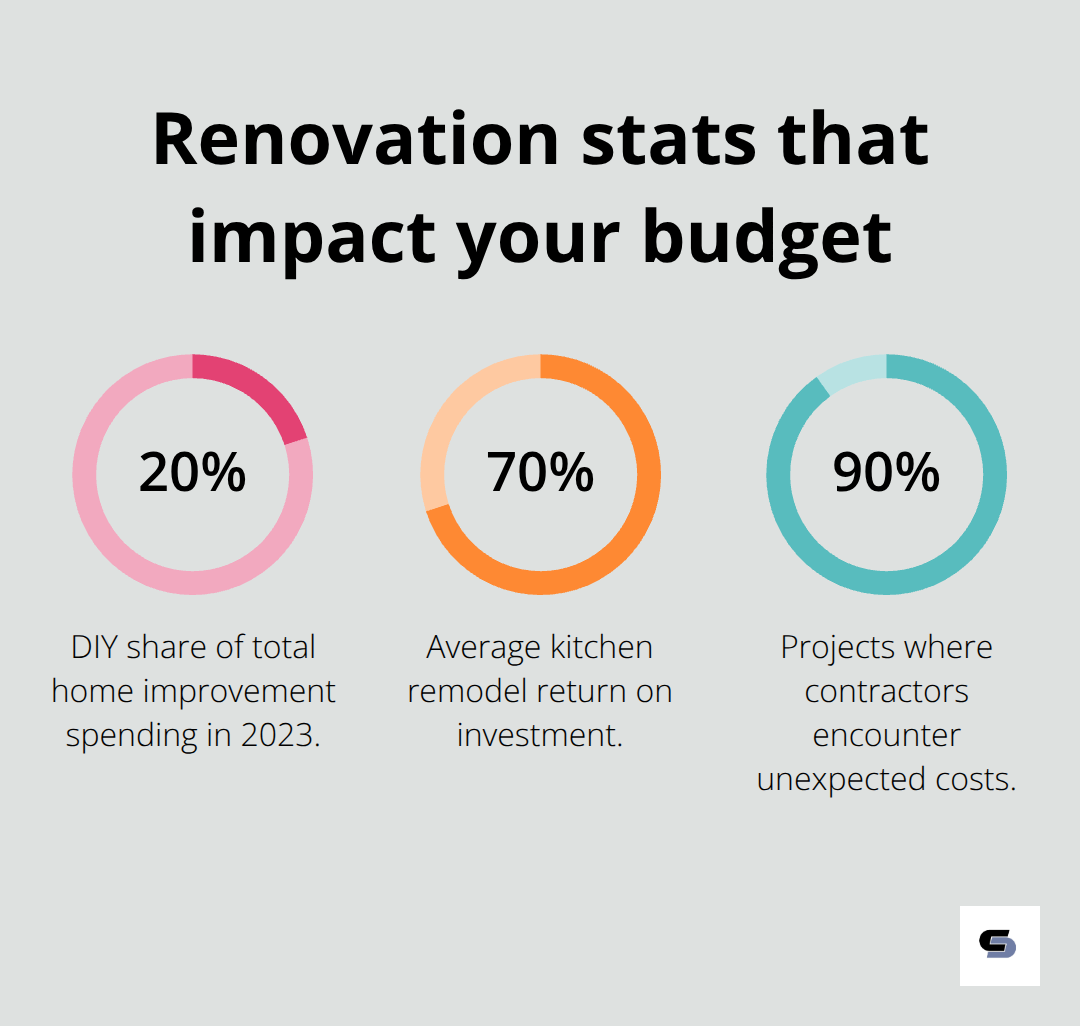

Project Size Dictates Your Best Option

Small projects under $15,000 work well with personal loans or promotional credit cards. Medium renovations from $15,000 to $50,000 benefit from personal loans or home equity options. Large-scale projects that exceed $50,000 require home equity loans, cash-out refinance, or construction loans with staged funds. Despite extraordinary growth in DIY activity, the DIY share of total improvement spending only increased 2.5 percentage points to about 20% in 2023. Kitchen remodels average $15,000 to $50,000 and return 70% of investment according to industry data. Add 10-20% buffer to your budget for unexpected costs that contractors encounter in 90% of projects.

Interest Rate Gaps Create Major Cost Differences

Home equity solutions offer rates from 7.68% to 8.08%, while personal loans average 11.66% and credit cards hit 21.91% according to Federal Reserve data. A $25,000 renovation that you finance through home equity at 8% costs $4,800 less over five years than the same amount on credit cards at 22%. Fixed rates provide payment predictability, while variable rates on HELOCs create monthly payment swings. Compare APRs, not just interest rates, since fees add 1-3% to your total cost.

Loan Terms Shape Your Monthly Budget

Personal loans typically offer 1 to 7 years for repayment, which creates higher monthly payments but lower total interest costs. Home equity loans extend 25-30 years, which reduces monthly payments but increases total interest over time. Construction loans provide staged payments that match your project timeline and minimise interest on unused funds. Choose terms that fit your monthly budget while you consider the total cost impact.

These factors work together to determine your optimal choice, but smart preparation can help you secure better terms regardless of which option you select.

How to Lock in the Best Financing Terms

Shop at least five lenders before you sign any agreement. Banks, credit unions, online lenders, and speciality home improvement companies offer dramatically different rates and terms for identical borrowers. Credit unions offer more favourable borrowing terms like lower interest rates and fewer fees, while online lenders like SoFi and LightStream compete aggressively for borrowers with excellent credit scores above 720. Request written quotes within the same 14-day period to minimise credit score impacts from multiple inquiries. Compare APRs rather than just interest rates since fees add significant costs – application fees range from $50 to $500, and some lenders charge monthly maintenance fees up to $12.

Strategic Application Schedule

Apply for finance during the first quarter when lenders push promotional rates to meet annual targets. Many lenders offer seasonal promotions from January through March with rates 0.5-1% below standard rates. Avoid applications during peak home purchase seasons in spring and summer when lenders tighten standards and reduce promotional offers. Complete your application early in the week since lenders process applications faster Monday through Wednesday. Submit all documents within 48 hours to prevent rate changes.

Rate Lock Protection

Lock your rate immediately after approval since mortgage rates change daily and personal loan rates adjust weekly based on Federal Reserve decisions. Most lenders provide 30-60 day rate locks at no cost, which protects you from market increases while you finalise project details. Some lenders offer extended locks for 90-120 days with small fees (typically 0.25-0.5% of loan amount). Rate locks become essential during volatile market periods when rates can jump 0.5-1% within weeks.

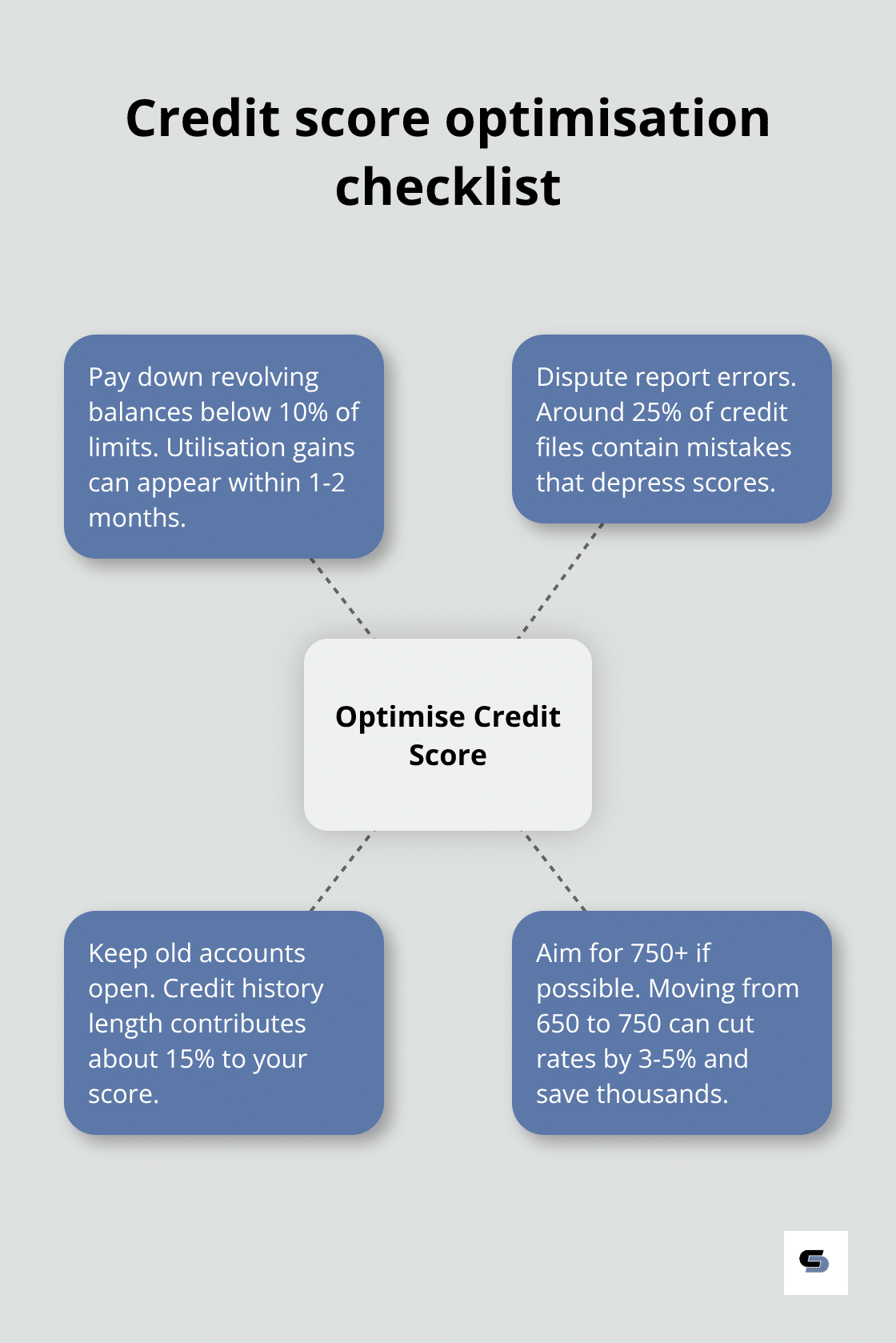

Credit Score Optimisation Strategy

Boost your score in 3-6 months through strategic actions that cost nothing but time. Pay down credit card balances to below 10% of limits – utilisation improvements show up within 1-2 months and can increase scores 10-20 points. Dispute errors on all three credit reports since 25% contain mistakes that lower scores unnecessarily. Avoid closure of old credit cards even with zero balances since credit history length accounts for 15% of your score calculation. The difference between fair credit at 650 and excellent credit at 750 cuts your interest rate by 3-5% on most loans, which saves $4,500 on a $30,000 renovation loan over five years.

Final Thoughts

Home improvement financing success depends on how well you match your project scope with the right funding solution. Personal loans work best for most renovations under $50,000 and offer quick approval with fixed payments. Home equity options provide lower rates for larger projects but require your property as collateral, while credit cards only make sense for small projects you can repay within months.

Your credit score creates the biggest impact on available rates and terms across all home improvement financing options. The difference between fair and excellent credit saves thousands in interest costs over the life of your loan. Project size determines which options work best – small renovations suit personal loans while major overhauls need home equity solutions (with their extended repayment terms).

Smart borrowers shop multiple lenders within a 14-day window and apply during first quarter promotional periods when rates drop. Rate locks protect against market increases while you finalise project details. We at Cameron Construction help Melbourne homeowners plan projects that maximise value while staying within budget, and the right financing choice combined with experienced contractors creates the foundation for renovation success.