Is Home Improvement Tax Deductible?

Many homeowners wonder: does home improvement tax deductible status apply to their renovation projects? The answer depends on several factors that the ATO considers when evaluating these expenses.

At Cameron Construction, we see clients miss valuable tax benefits because they don’t understand which improvements qualify. Understanding these rules can save you thousands of dollars on your next renovation project.

What Makes Home Improvements Tax Deductible

The ATO draws a clear line between repairs and capital improvements when it determines tax deductibility. Repairs restore your property to its original condition and qualify for immediate deductions if the property generates income. Capital improvements add value or extend the useful life of your property and must be depreciated over time. For example, a broken window repair counts as a repair, while new energy-efficient windows throughout your home qualify as a capital improvement.

Immediate Deductions vs Long-Term Depreciation

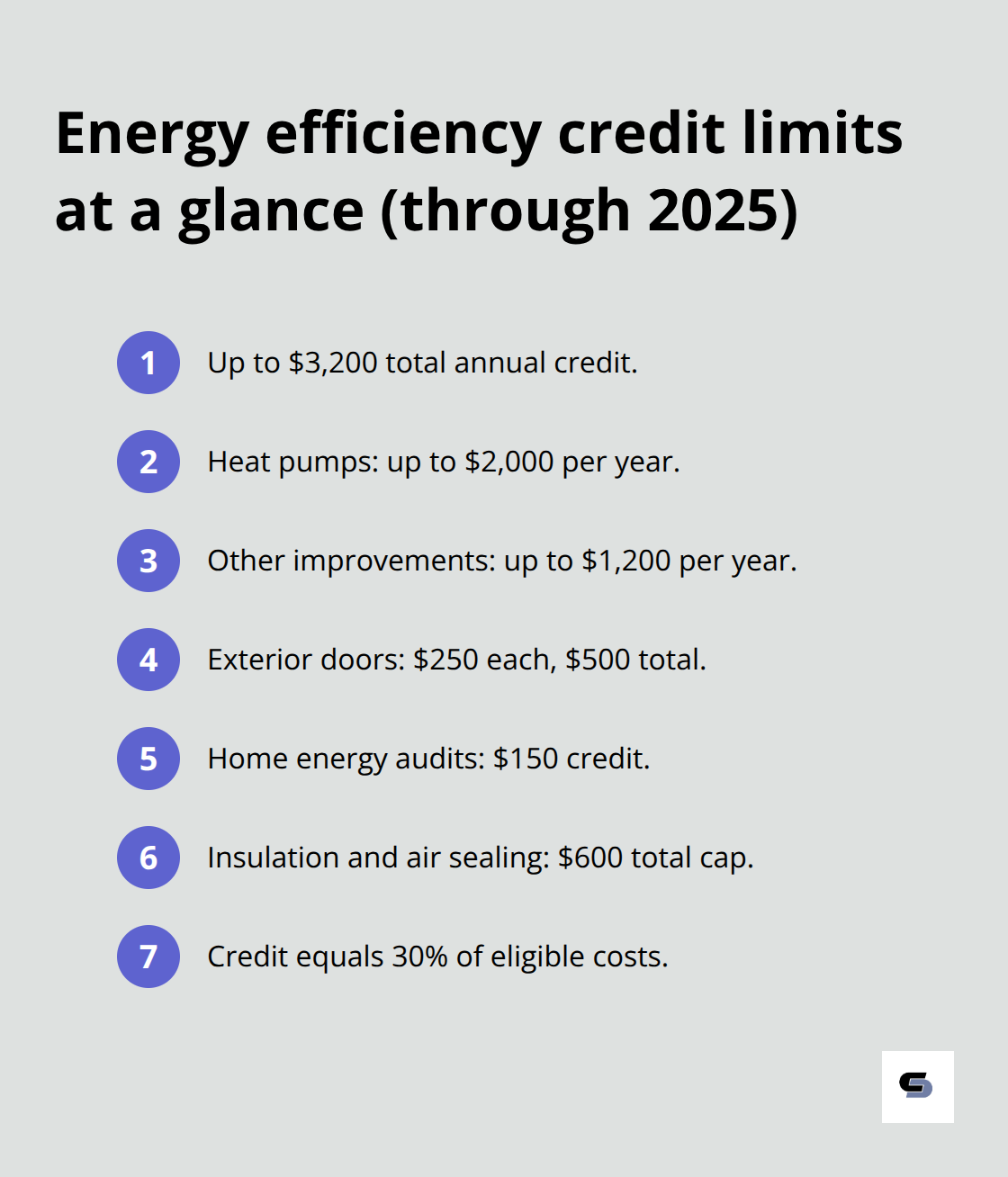

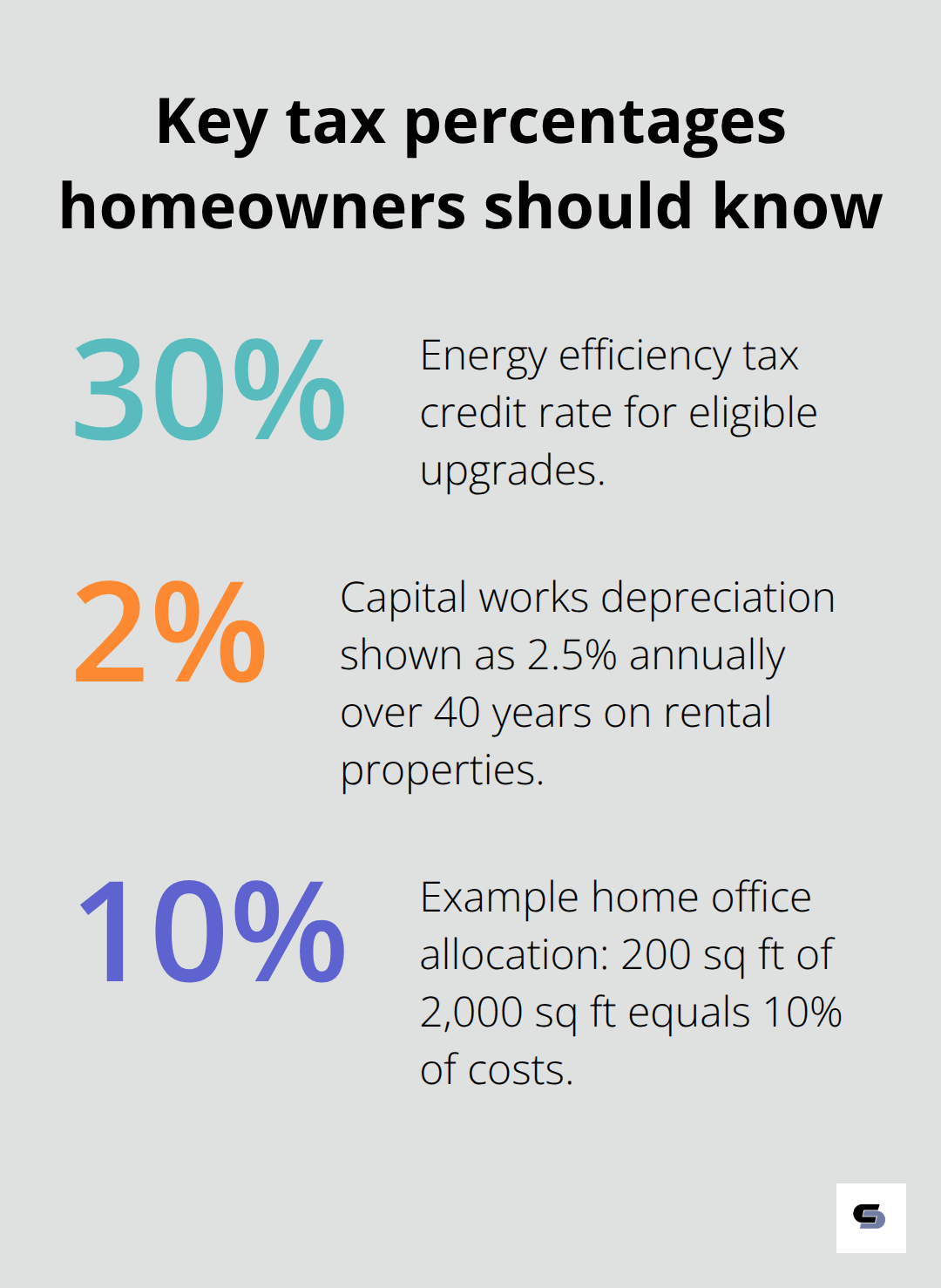

Investment property owners can deduct repair costs immediately in the tax year they occur. The ATO allows landlords to claim up to $2,000 for routine maintenance like repainting without complex documentation. Capital improvements on rental properties depreciate at 2.5% annually over 40 years. Primary residence improvements rarely qualify for immediate deductions but reduce capital gains tax when you sell. Energy-efficient upgrades can earn up to $3,200 in tax credits through 2025 (with specific limits like $600 for windows and $2,000 for heat pumps).

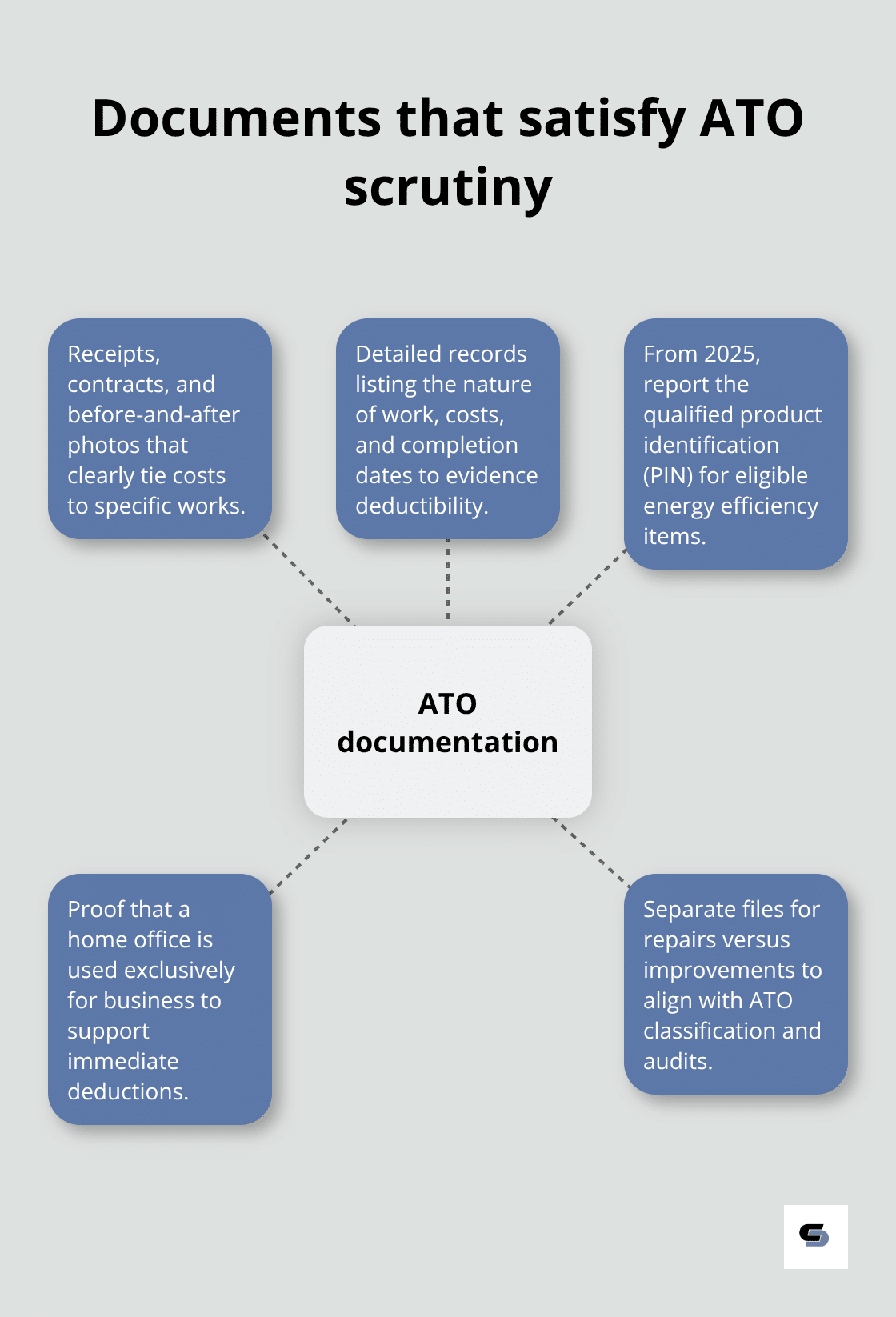

Documentation Standards That Pass ATO Scrutiny

Keep every receipt, contract, and before-and-after photo for renovation projects. The ATO requires detailed records that show the nature of work, costs, and dates of completion. For energy efficiency credits that start in 2025, you must report the qualified product identification number (PIN) from approved products. Home office renovations need documentation that proves exclusive business use of the renovated space.

Tax professionals recommend separate files for repairs versus improvements, as auditors frequently scrutinise these distinctions during reviews.

Medical Necessity Modifications

The ATO allows deductions for accessibility modifications when a medical practitioner prescribes them. These improvements can qualify for both primary residences and investment properties (unlike most other home improvements). Wheelchair ramps, modified bathrooms, and other medically necessary modifications require proper documentation from healthcare providers to support your claim.

Now that you understand which improvements qualify for deductions, let’s explore the specific types of home improvements that offer the best tax advantages.

Which Home Improvements Offer Real Tax Benefits

Energy Efficiency Upgrades That Pay Back

The Energy Efficient Home Improvement Credit delivers up to $3,200 in tax credits through December 2025, with specific maximums that smart homeowners target. Heat pumps qualify for up to $2,000 annually, while other improvements cap at $1,200 yearly. Exterior doors earn $250 each (with a $500 total limit), and home energy audits add $150 to your credit potential.

The ATO requires products to meet International Energy Conservation Code standards and mandates that homeowners report qualified manufacturer identification numbers from 2025 onward. Insulation and air sealing materials are limited to $600 total. These upgrades provide the 30% tax credit as a bonus on top of energy savings.

Home Office Renovations With Business Deductions

Home office improvements qualify for immediate tax deductions when the space serves exclusively for business purposes. Built-in bookcases, upgraded electrical systems, and dedicated circuits all count as deductible business expenses. The ATO allows deductions based on the percentage of your home used for work, so a 200-square-foot office in a 2,000-square-foot home qualifies for 10% of renovation costs.

Professional contractors often recommend that homeowners separate office renovations from personal home improvements to simplify tax documentation. Business owners miss thousands in deductions when they renovate their entire home without first isolating the business portion.

Medical Modifications That Qualify Everywhere

Medical necessity modifications represent the only home improvements that qualify for deductions on primary residences and investment properties alike. Wheelchair ramps, roll-in showers, and grab bar installations require written prescriptions from licensed medical practitioners to support your claim. Home renovations are processed as immediate deductions rather than spread over multiple years like capital improvements.

Healthcare providers must document the specific medical condition and explain why the modification addresses that condition directly. These improvements often increase property value while also providing immediate tax relief, which creates a unique advantage over standard renovations that only affect future capital gains calculations.

How Property Value Improvements Affect Your Taxes

Major renovations that increase property value create different tax implications than the energy efficiency and medical improvements we just covered. Kitchen remodels, bathroom upgrades, and structural additions fall into capital improvement categories that affect your taxes when you sell rather than provide immediate deductions. These projects typically cost $15,000 to $50,000 for kitchens and $10,000 to $25,000 for bathrooms according to recent industry data, which makes their tax treatment particularly important for homeowners.

Kitchen and Bathroom Renovations Impact Capital Gains

Kitchen and bathroom renovations add substantial value to your home but qualify as capital improvements that reduce capital gains tax when you sell. The ATO requires homeowners to add renovation costs to their property’s cost base, which lowers taxable gains at sale time. A $30,000 kitchen renovation reduces your capital gains by that amount when you eventually sell your property.

Investment property owners can depreciate new fixtures and appliances over their effective life while they claim the structural work at 2.5% annually over 40 years. Proper documentation of these major renovations saves homeowners thousands in capital gains taxes.

Structural Extensions Generate Long-Term Tax Benefits

Home extensions and additions create the largest capital improvements most homeowners make, often from $50,000 to $150,000 for significant projects. These improvements must be depreciated over time for investment properties rather than claimed immediately. Second-storey additions, room extensions, and garage conversions all qualify as capital works that reduce future tax obligations.

The key difference from repairs is that extensions change your home’s character and functionality rather than simply maintain existing features. Investment property owners benefit from the 40-year depreciation schedule that applies to these structural improvements.

Landscaping and Exterior Improvements

Landscaping improvements like retaining walls, driveways, and permanent outdoor structures also qualify as capital improvements when they exceed routine maintenance costs. The ATO distinguishes between basic garden maintenance and substantial improvements that add lasting value to your property.

Exterior renovations such as new roofing systems, siding replacement, and deck installations fall under capital works provisions. These improvements must be documented carefully to support future tax claims when you sell the property or calculate depreciation schedules for rental properties.

Final Thoughts

The question “does home improvement tax deductible” status apply to your project depends on ATO classifications and proper documentation. Energy efficiency upgrades offer immediate credits up to $3,200 through 2025, while medical modifications provide deductions for both primary and investment properties. Home office renovations qualify for business expense deductions when spaces serve exclusively for work purposes.

Capital improvements like kitchen renovations and structural extensions reduce capital gains taxes when you sell rather than provide immediate benefits. Investment property owners can depreciate these improvements over time while they claim repairs immediately in the tax year they occur. Professional tax advice becomes essential given the complexity of these regulations and the substantial money at stake (tax professionals help distinguish between repairs and capital improvements while maximising available deductions and credits).

We at Cameron Construction recommend consultation with tax advisers before you start major renovation projects. Proper planning and documentation can maximise both your home’s value and tax benefits from your investment. Our team understands how strategic renovation approaches create the best outcomes for Melbourne homeowners.